Most business owners want the same thing: more profit.

Yet many focus on growing revenue instead. The problem? Revenue growth does not guarantee profitability. In fact, for many businesses, higher sales often lead to higher stress, tighter cash flow, and more complexity.

If you want to understand how to increase business profit, the answer is not working longer hours or chasing more leads. The answer is structure.

This approach is inspired by the principles outlined in Seven Pillars to Profit, a practical framework that breaks profitability into clear, manageable building blocks.

Why Increasing Business Profit Is Harder Than Increasing Revenue

Revenue is visible. Profit is not.

Many businesses appear successful on the surface but struggle behind the scenes due to:

-

Poor cash flow management

-

Inconsistent sales

-

Rising operational costs

-

Owner dependence

Without systems, profit leaks quietly. Fixing profit requires clarity across the entire business, not just the sales line.

Pillar 1: Financial Visibility Is the Foundation of Business Profit

You cannot increase business profit if you do not clearly understand where money is being made or lost.

This pillar focuses on:

-

Knowing the difference between revenue, profit, and cash flow

-

Identifying which products, services, or clients are most profitable

-

Tracking margins, not just total sales

Financial clarity allows owners to focus on what actually drives profit instead of guessing.

Pillar 2: Predictable Sales Increase Business Profit

Unpredictable sales create unpredictable profit.

A consistent sales system improves profitability by:

-

Stabilizing cash flow

-

Reducing reactive decision-making

-

Improving pricing discipline

Instead of chasing volume, profitable businesses focus on consistency and conversion.

Pillar 3: Marketing That Attracts Profitable Customers

Not all customers are equal.

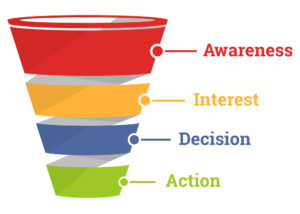

Marketing plays a major role in how to increase business profit because it determines who enters your pipeline. Strong marketing:

-

Attracts customers willing to pay for value

-

Aligns messaging with higher-margin services

-

Reduces wasted ad spend

Better marketing is about alignment, not noise.

Pillar 4: Streamlined Operations Protect Profit Margins

Operational inefficiencies quietly drain profit.

This pillar focuses on:

-

Reducing errors and rework

-

Creating repeatable processes

-

Improving delivery consistency

When operations are streamlined, margins improve without raising prices.

Pillar 5: The Right Team Improves Business Profit

People costs are one of the largest expenses in most businesses.

Profit improves when teams have:

-

Clear roles and expectations

-

Proper training and accountability

-

Lower turnover and friction

Strong teams support growth without increasing chaos.

Pillar 6: Leadership Decisions That Increase Business Profit

Leadership is not about doing more. It is about deciding better.

Profit-focused leaders:

-

Say no to unprofitable work

-

Prioritize high-impact activities

-

Use data to guide decisions

Leadership discipline prevents profit erosion over time.

Pillar 7: Adaptability Protects Long-Term Profit

Markets change. Costs rise. Customer expectations shift.

Businesses that maintain profitability are adaptable. This pillar focuses on:

-

Adjusting pricing and offerings when needed

-

Monitoring industry trends

-

Identifying risks early

Adaptability ensures today’s profit lasts into the future.

Practical Steps to Increase Business Profit Starting Now

To take action:

-

Review each pillar honestly

-

Identify the weakest area

-

Make one focused improvement

-

Measure results consistently

Small, targeted changes often create the biggest profit gains.

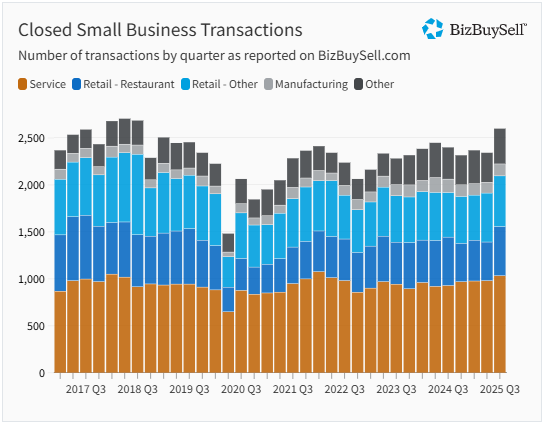

Why Increasing Business Profit Also Increases Business Value

Profit is more than income. It is leverage.

Businesses with stable, predictable profit:

-

Command higher valuations

-

Attract stronger buyers

-

Are easier to operate and scale

Even if selling is not on your radar, profit strengthens every option you have.

Final Thoughts: Profit Is Built, Not Chased

Learning how to increase business profit starts with structure, not hustle.

The 7 Pillars framework provides a clear way to strengthen the foundation of your business so profit becomes consistent instead of accidental.

If you want a deeper dive into the framework behind these principles, Seven Pillars to Profit is available on Amazon.