SELL YOUR BUSINESS

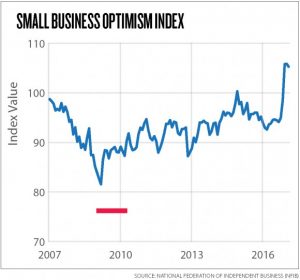

Now maybe the best time to sell your business. Small business optimism shatters the record set 35 years ago according to NFIB Small  Business Optimism Index which soared to 108.8. The latest survey showed that now may be the time to get top dollar your company. Some of the findings follow:

Business Optimism Index which soared to 108.8. The latest survey showed that now may be the time to get top dollar your company. Some of the findings follow:

- Job creation plans and unfilled job openings at record highs

- The percentage of small business owners saying it is an excellent time to expand tied the May 2018 all-time high.

- Plans for inventory investment were the strongest since 2005 and capital spending plans the highest since 2007. Today’s favorable environment is pushing many business owners to consider selling their companies. Robust earnings growth, large cash balances on company balance sheets, and higher bank lending are pushing up business valuations. A large percentage of business owners are considering selling their company, but don’t have the experience to manage a complex transaction.

KEY POINTS TO SELL YOUR BUSINESS

The most critical thing about selling a company is how much money does the owner ends up with when the transaction is complete. This will be mostly determined by the valuation of the company. The valuation is mostly influenced by cash flow or discretionary earnings. Companies are sold for some multiple of earnings depending on the quality of the earnings. The majority of businesses will sell with a multiple of 2.5 +/- 1 of earnings. Larger companies demand higher multiple than small ones. Click here for a free preliminary appraisal

Business buyers would like to see the company with strong recent performance with strong projections for future growth ideally. Don’t worry if your company doesn’t have high performance but realize that will affect the multiple you can expect. No business is perfect, and the right things wrong may be helpful in some cases. Buyers are attracted to companies that they can get for a slight discount if something is wrong that they can fix.

The perfect time to sell a business is when you’re ready to retire, exit or you no longer have an interest in running the business. Lack of interest or burn-out is one of the most common reasons to sell a business. Operating a business while suffering burn-out usually leads to the company declining due to a lack of focus and effectiveness.

Preparing a business for sale is critical if you want to get top dollar or even get it sold. The financials must be complete and include an adjusted profit and loss, and balance sheet, and cash flow statement for three years to get the most money for your business. Additionally, year to date (YTD) financials should be part of the package with three years of tax returns. It is normal to have financial adjustments with add-backs normalize income. Common add backs include depreciation, discretionary expenses, Interest expense, taxes. There may be other adjustments that show earnings far higher than what may appear on tax returns.

STEPS NEEDED TO BE DONE IN PREPARATION TO SELL YOUR BUSINESS:

Write off dead or slow-moving inventory.

Replace or upgrade defective machinery.

Remove employees or managers that lack skills or competency for their role.

Take care of housekeeping issues to improve the presentation of the business.

Update the company website.

Update and social media sites with new content.

MAINTAINING CONFIDENTIALITY

When talking about selling a business, we always hear about confidentiality. Why is it important and what can be done to maintain it? Confidentiality is vital for companies because if the market knows a company is for sale, customers, suppliers, and employees can get concerned. It may be necessary to notify employees about the company being for al sale. It’s essential to align the interest of the employee with a successful transaction that includes a positive outcome for all parties.

Financial incentives may be a consideration upon the close of the transaction to align an owner’s interest with employees well being to ensure the employee is helpful throughout the process. It also persuades employees to maintain confidentiality as their interest can also be diminished.

ASSEMBLING YOUR TEAM

Many business owners think they can save on fees by dealing with a transaction themselves, but often, legal, accounting, and financial advisers will pay for themselves many times over. At a minimum, you should get advice on the value of the business, tax consequences, legal consequences after the sale.

The size and complexity of your transaction will determine how large your team should be. They should help prepare the company for potential buyers and assist throughout the due diligence process. Advisors should offer guidance on negotiating the most favorable terms and conditions. Handling the sale of a business requires a lot of work. It is virtually impossible to run a business while trying to sell without outside help. You risk getting less money for your business or not selling it all if you attempt to go it alone.

It’s very challenging for business owners to have the objectivity and time to draft marketing materials and coordinate the sales process. Owners may be emotionally invested in their business, making it difficult to price and market their company effectively. Assemble business advisers to provide fresh, objective views about your company so you can maximize the money you receive when you get your business sold.

Hopefully, your business has given you the financial rewards and the success you wanted; however, if it’s time to move on, we are here to help you exit. You don’t have to spend another day in a business that you are ready to exit. We have created a Business Selling System designed to get your business sold safely with minimum stress and maximum profit. Schedule a call today if you’re ready to get a custom plan to sell your business.

click here to schedule call any time of day or night